Contents:

https://forexhero.info/ averages are trend-following indicators that lag price. This means the actual trend changes before the moving averages generate a signal. Many traders are turned off by this lag, but this does not make them totally ineffective. Moving averages smooth prices and provide chartists with a cleaner price plot, which makes it easier to identify the general trend. Momentum trading is the practice of trying to make money by trading stocks along with a trend. For example, if a stock is soaring after releasing a stellar earnings report, a momentum trader might try to buy shares and ride the stock’s price higher.

Here’s Why Momentum in Cavco (CVCO) Should Keep going – Nasdaq

Here’s Why Momentum in Cavco (CVCO) Should Keep going.

Posted: Fri, 24 Feb 2023 13:50:00 GMT [source]

However, https://traderoom.info/ investors do this in a systematic way that includes a specific buying point and selling point. Rather than be controlled by emotional responses to stock prices like many investors are, momentum investors seek to take advantage of the changes in stock prices caused by emotional investors. Momentum investing seeks to take advantage of marketvolatilityby taking short-term positions in stocks going up and selling them as soon as they show signs of going down. In this case, the market volatility is like waves in the ocean, and a momentum investor is sailing up the crest of one, only to jump to the next wave before the first wave crashes down again.

Buying high and selling higher is momentum traders’ enviable goal, but this goal does not come without its fair share of challenges. Choose yourholding periodwisely because risk increases the longer you stay positioned. Day trading works well with momentum strategies, but it forces players to take larger positions to compensate for the greater profit potential of multi-day holds. Conversely, it is best to reduce position size when holding through multiple sessions to allow for greater movement and stop placement further away from the current action.

Momentum breaks through level 100

The idea of selling losers and buying winners is seductive, but it flies in the face of the tried and true Wall Street adage, “buy low, sell high.” He does this using the rank function in the Microsoft Excel spreadsheet program. Henning considers a successful trading strategy one that will earn him an average monthly return of 10% on his invested capital. If a system fails to generate these kinds of results, Henning believes it is time to pause, reexamine and adjust or replace the trading system.

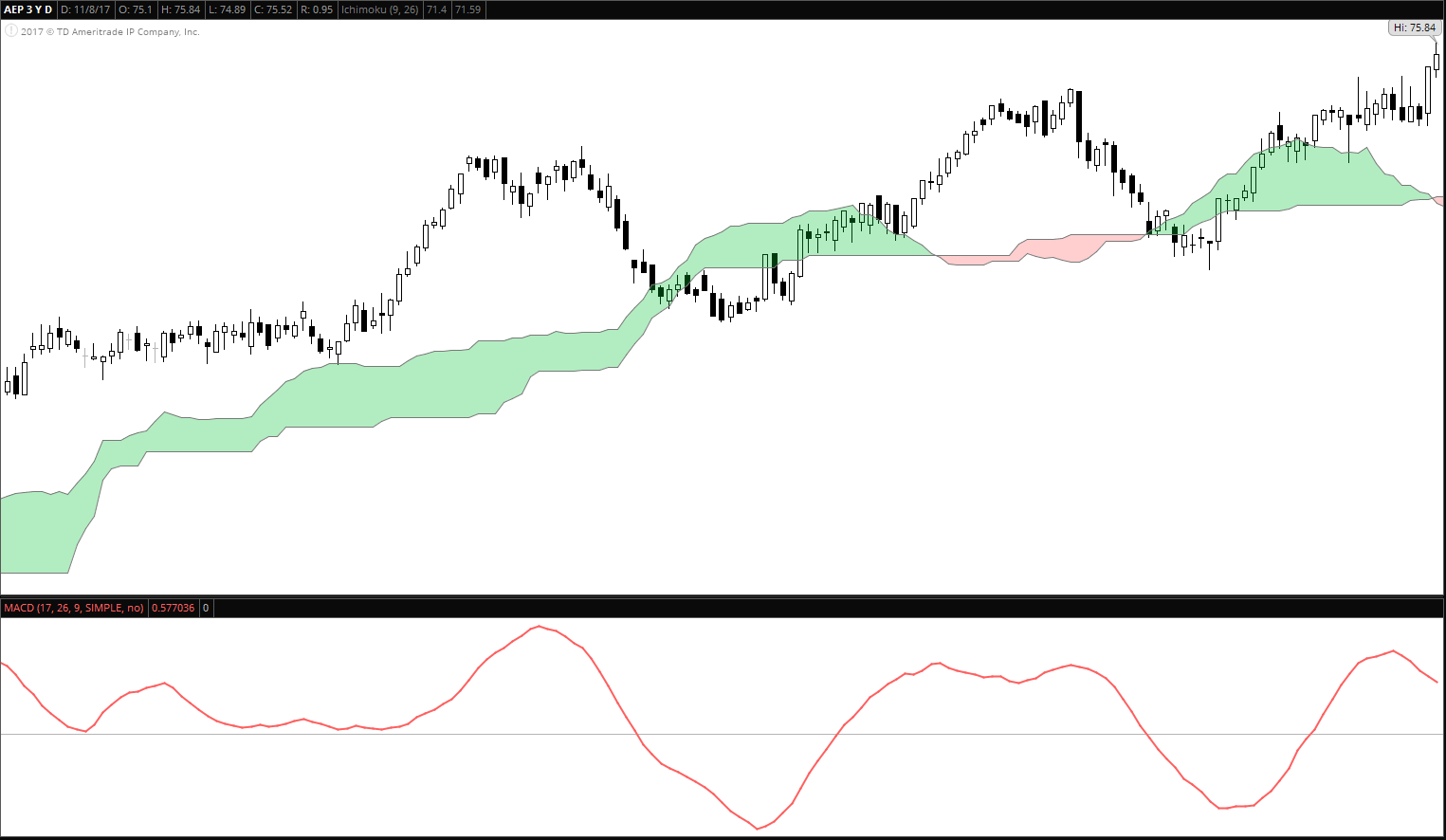

It is remarkable because the MACD histogram broke slightly below the previous low. However, if you compare the line connecting the local lows of the price chart and the line connecting the local lows of the histogram, you will see a significant divergence between the lines. The third signal formed when divergence continued and the price broke through another high in the chart. There is a triple divergence and a good profit from the sale. You enter a buy trade after the close of the next signal candlestick, whose histogram bar in the indicator window will be higher than the previous one. When the indicator line enters the oversold zone, there is a potential buy signal.

Skilled traders understand when to enter into a position, how long to hold it for, and when to exit; they can also react to short-term, news-driven spikes or selloffs. The goal is to work with volatility by finding buying opportunities in short-term uptrends and then sell when the securities start to lose momentum. Momentum investing is a trading strategy in which investors buy securities that are rising and sell them when they look to have peaked. On paper,momentum investingseems less like an investing strategy and more like a knee-jerk reaction to market information.

Momentum trading is commonly used in the stock market and the forex market. In the stock market, momentum traders typically focus on individual stocks that are experiencing strong upward or downward trends. In the forex market, momentum traders may focus on currency pairs that are experiencing strong trends, either up or down.

Overbought/Oversold zones

https://forexdelta.net/ following and momentum strategies share similarities in that they both focus on price action, buy high on uptrends and sell low on downtrends. However, whereas momentum based trading relies on aspects of fundamental analysis to make predictions, trend followers tend to focus solely on price and the size of their trades. This is partially to reduce time and make quicker trades, but also to help reduce losses. Trend followers measure their position size with the trend rather than placing a large amount of capital in one position. Momentum is one of the most prevalent technical indicators used in quantitative trading.

- There’s no guarantee that buying pressures will continue to push the price higher.

- It can also be classified as a leading indicator, rather than a lagging, as it helps to generate buy and sell signals before a trader opens a position.

- Next, you can choose the price, based on which the indicator is built .

The Momentum determines divergences that are often preceding a price correction or a trend reversal, allowing to make a greater profit. Most traders like the simplicity and straightforwardness of the indicator. If you set a longer period, you can define the trend, or you can use the momentum with a shorter period to spot the overbought/oversold zones. In the above figure, the black box marks potential trading signals in the AUDUSD chart .

Price Rate Of Change Indicator – Definition, Formula and the ROC Trading Strategies

Position management takes time to master because these securities often carry wide bid/ask spreads. Wide spreads require larger movement in your favor to reach profitability while also grinding through wide intraday ranges that expose stops—even thoughtechnicalsremain intact. Early positions offer the greatest reward with the least risk while aging trends should be avoided at all costs. The opposite happens in real-world scenarios because most traders don’t see the opportunity until late in the cycle and then fail to act until everyone else jumps in. I accept FBS Agreement conditions and Privacy policy and accept all risks inherent with trading operations on the world financial markets. The emergence of the extreme values on the chart consisting of 100 and more candles is a signal that current tendency will proceed.

Momentum is an important component of both day trading and long-term investing. In day trading, we recommend that you identify some of the best momentum stocks and then come up with a strategy. The field of momentum is extremely large and highly-profitable. In fact, a look at historical performance shows that momentum traders make more money than other types of investors. Volatility is the degree of change in an asset’s price – if a market is highly volatile, it means that there are big price swings, while a market with low volatility is comparatively stable.

Momentum trading strategies: a beginner’s guide

A momentum trader doesn’t necessarily attempt to find the top and bottom of a trend, but instead focuses on the main body of the price move. They aim to exploit market sentiment and herding – the tendency for traders to follow the majority. It’s important to understand that momentum trading involves a good deal of risk. In essence, you’re making a decision to invest in a stock or ETF based on recent buying by other market participants.

Alpha Metallurgical (AMR) Is Attractively Priced Despite Fast-paced … – Nasdaq

Alpha Metallurgical (AMR) Is Attractively Priced Despite Fast-paced ….

Posted: Tue, 28 Feb 2023 13:50:00 GMT [source]

The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Figuring out what is MACD & how to use the Moving Average Convergence Divergence indicator to make a profit. Traders who use this indicator for the first time are advised to leave the default values. When the fast Stochastic line breaks through the slow one, be prepared to enter a buy trade. An entry signal will be the moment when the fast line goes back to the range of 20% – 80%.

This formula shows that the Momentum indicator is the difference between the most recent closing price and the closing price n periods ago. The n factor is determined by the trader independently and is specified in the momentum indicator settings. Traders also develop momentum strategies on a sector-specific basis and set up sector-specific trades. The idea here is to identify sector which exhibits strong momentum, this can be done by checking momentum in sector-specific indices.

If the indicator shows downward price movement and stays below the median, the trend is down. In another article, we looked at the return during the last hour of trading. The trading edges are small, but this article shows that there are possibilities to find market inefficiencies.

Another batch of momentum capital enters as the trade evolves, generating counter swings that shake out weak hands. The hot money population finally hits an extreme, triggering volatilewhipsawsand major reversals. Within AAII’s Stock Investor Pro program, there is both 10-day average daily volume and average monthly volume over the last three months.

- For stocks that have fallen significantly off their high there are many people waiting for any rebound in price to sell in order to minimize their losses.

- The momentum indicator can be used to provide trade signals, but it is better used to help confirm the validity of trades based on price actions such as breakouts or pullbacks.

- In fact, high-frequency traders measure momentum on a minute to minute or hourly basis.

- The listed trading strategies are unique in their own way and are powerful tools in the hands of experienced traders who practise trading them to manage their personal finance and virtual funds.

- Many of the techniques he used became the basics of what is now called momentum investing.

Description of Laguerre RSI parameters and forex trading strategies with Laguerre RSI indicator. It is not relevant to compare the Bollinger Bands, the Momentum indicator, the Fibonacci, or the Blade Runner strategies because they all have different trading objectives. The listed trading strategies are unique in their own way and are powerful tools in the hands of experienced traders who practise trading them to manage their personal finance and virtual funds. It should be noted that a limitation of the momentum indicator is that one needs to filter signals using other indicators in clear trends. The divergence between the price chart and the indicator line signals a potential trend reversal. In conclusion, I want to note that you can choose other parameters for the MACD periods that you consider more efficient.

Stock-Exchange-Data-Analysis

The random.forest.importance function rates the importance of each feature in the classification of the outcome, i.e. class variable. The function returns a data frame containing the name of each attribute and the importance value based on the mean decrease in accuracy. When you are ready, open a live account and start trading the live markets.

One of the most accurate signals of the indicator is the divergence between the Moving Average Convergence Divergence and the price chart. The signal line is the EMA calculated based on the MACD line. Differently put, the MACD line is flattened using a simple moving average to filter signals. The overbought conditions and oversold zones in the market give the trader an idea of where the price can be stopped and a reversal, or at least a correction, can occur. With proper use of these zones, a trader can make profits from both the price fall and its rise.

0 Comments