Contents:

This sort of buyout helps in getting rid of any areas or services for the product duplication. It can also reduce the operational expenses, which in turn can lead to an increase in profits. To know the Internal Rate of Return i.e. return generated by a newly acquired firm. Calculating the exit value using EV/EBITDA multiple and then subtracting the value of debt and cash to get the exit value of company equity. Another important reason for an LBO is when a smaller business seeks to be acquired by a larger competitor. As a result, the smaller business can expand significantly, onboard new clients, and scale rapidly.

https://1investing.in/ firms are interested in management buyouts , in which a share is taken in the management of the business being acquired. Often, they play critical roles in leveraged buyouts, which are buyouts financed with borrowed money. Any technique to multiply gains and losses in finance is known as leverage. Buyout means when a firm purchases the controlling interest of another firm to takeover assets or its business operation or both.

Most Popular News

IRR depends on many different things such as the future financial performance, growth rate, EBIT, the purchase price and the size of equity contribution. A public company has an obligation to produce annual reports with the numerous regulations required by the security and exchange commission. Its management must meet with the security analysts who follow the firm’s stock and deal wit h investor concerns. This improvement in financial incentives for the firm’s managers should result in greater effort on the part of management.

What is a leveraged buyout quizlet?

Definition. 1 / 19. Leveraged buyout is a specific type of acquisition transaction, where most of the purchase price is funded with debt, and the company is ‘taken private’ –The remaining portion is funded with equity by the financial sponsors, or PE investors.

Often, assets of the company being acquired are used as collateral for loans in addition to assets of the acquiring company. The purpose of leveraged buyouts is to allow firms to make large acquisitions without having to commit a lot of capital. Leveraged buyout is one of the intriguing routes for those investors who do not have high equity in their pocket and can acquire another target company.

What are the Risks of Leveraged Buyouts?

This may pose a challenge for management to utilise the synergy of resources between the companies. May bring new products from the firm under acquisition, providing a competitive edge for the acquiring company and new customers under its umbrella. The acquiring firm may benefit by incorporating new products or technology of the firm under acquisition into its current product line, without any need to develop or license new technologies.

How do you get a leveraged buyout?

- Build a financial forecast for the target company.

- Link the three financial statements and calculate the free cash flow of the business.

- Create the interest and debt schedules.

- Model the credit metrics to see how much leverage the transaction can handle.

To deal with this problem, the company may go for equity recapitalisation, i.e. raise funds by issuing new equity and use those funds to buy back debt securities. The management works towards increasing profits and cash flows by reducing operating costs and altering marketing strategies to meet the set targets. Under this, the PE company purchases the outstanding stocks of a public company using bank loans and privatizes them. In the end, they repackage the business and sell the ownership through an Initial Public Offering . A leveraged buyout might be a prudent choice for business owners if their companies are underperforming.

Big leveraged buyouts, set to deliver big returns

For one thing, it can increase management commitment and effort because they have greater equity stake in the company. After an LBO, however, executives can realize substantial financial gains from enhanced performance. The most significant disadvantage of such a buyout is the increase in debts.

Fitch Affirms Sophos at ‘B’; Outlook Stable – Fitch Ratings

Fitch Affirms Sophos at ‘B’; Outlook Stable.

Posted: Tue, 07 Feb 2023 08:00:00 GMT [source]

Often the financing needed for an MBO is very substantial, and is typically a mixture of debt and equity originating from sellers, financiers, and sometimes the seller. An analysis is prepared to estimate the current value of the company to a financial buyer. Constant returns along side with the firm’s historical results will result in LBO analysis providing an estimate of what purchase value a buyer will be willing to pay in accordance with the analysis. LBOs came into existence in the 1950s and 1960s where their business was limited to medium sized organizations. The real phase of LBOs started from 1970 and gradually emerged as a strong entity. Since it has to raise a significant amount of capital through debt the company must ensure that it has a steady and predictable cash flow.

Private equity bosses lose sleep over buyout boom going bust

Because current assets are less profitable than fixed assets, this is the case. It is a useful tool in the hands of the finance manager when determining the amount of debt in the firm’s capital structure. “We expect Q1 to be a record quarter and though the dollar rates are expected to increase in the later part of the year, the overall yield curves continue to be attractive. We will see debt capital market issuance to continue from sectors, which have high capex intensity, like renewables, infrastructure, commodity etc,” Murugaiyan said in an interview to ETMarkets.com. Recapitalisation is not necessarily an acquisition but can be the result of the acquisition. When a company borrows funds and uses them to acquire another company, recapitalisation is an automatic outcome.

- In an LBO, the acquiring company uses its own assets as collateral for the loan in hopes future cash flows will cover the loan payments.

- If you have previously used our Financial Dictionary, then the words checked and their meaning would be displayed under this category.

- In addition, some of the transactions have negative effects on the communities in which the firms are located.

- Ordinary shares are the riskiest among the parts of an LBO capital structure.

- Leveraged buyout is one of the intriguing routes for those investors who do not have high equity in their pocket and can acquire another target company.

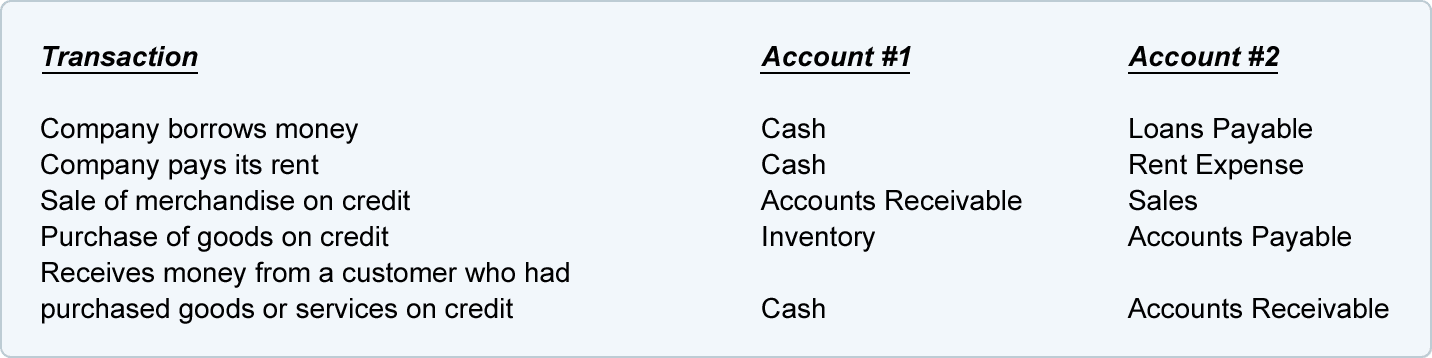

For instance, a company may issue three bonds against one equity share. A company decides its capital structure based on the type and size of the business, life cycle stage, cost of capital and other such factors. However, changes in the company’s financial condition and the above factors may motivate the company to go for recapitalisation.

Our Legal Journal contains a vast assortment of resources that helps in understanding contemporary legal issues. Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. Acquiring companies generally target IRRs of around 20-30% or higher to make LBOs profitable. The last step is to calculate the Internal Rate of Return on the initial investment. These will help you master key financial concepts and nuances of the trade to help you advance in your career in this sector.

What is leverage meaning in business?

Leverage is the amount of debt a company has in its mix of debt and equity (its capital structure). A company with more debt than average for its industry is said to be highly leveraged.

A leveraged buyout is a form of business acquisition in which the acquiring company buys shares of another company using borrowed funds. Simply put, under a leveraged buyout one company raises funds to acquire another company using debt. In return, the acquiring company repays such debt sing the cash flows generated from the acquired company.

A leveraged buyout is akin to buying a house utilizing a combination of a down payment and a mortgage – in both transactions we preserve cash by putting down a modicum in cash and then borrowing the rest. In an LBO, the “down payment” is called Equity and the “mortgage” is called Debt. Leveraged buyouts use large sums of borrowed money, with the company’s purchased assets being used as collateral for the loans. Just 10 per cent of the funding can be raised by the organisation conducting the LBO, with the remainder funded by debt. Buyouts occur when an investor acquires more than 50 per cent of the business, resulting in a control transition. Companies that specialise in funding and facilitating transactions operate on deals on their own or together and are typically funded by institutional investors, affluent individuals or loans.

Three special studies were made by Kaplan , Muscarella and Vetsuypens , and Smith . Studies revealed that the possession by a leveraged buyout refers to after two to four years led to an increment in operating profit by forty percent. Other companies where KKR has actively invested are Bharti Infratel , Max India Group , Coffee Day Resorts , Dalmia Cement/Avnija and JSW Group . Being a relatively new business concept for us, this Article aims to highlight what ‘LBO’ is all about, its advantages and disadvantages.

What is a leveraged buyout for dummies?

For those of you wondering, in layman's terms, a leveraged buyout is the acquisition of another company using a significant amount of borrowed money to meet the cost of the acquisition.

0 Comments